CNX Resources Delivers 23 Consecutive Quarters of Free Cash Flow Generation

Company reports $226 million in Q3 free cash flow while raising 2025 guidance and continuing aggressive share buyback program.

October 30, 2025

By Positive Energy Hub Staff

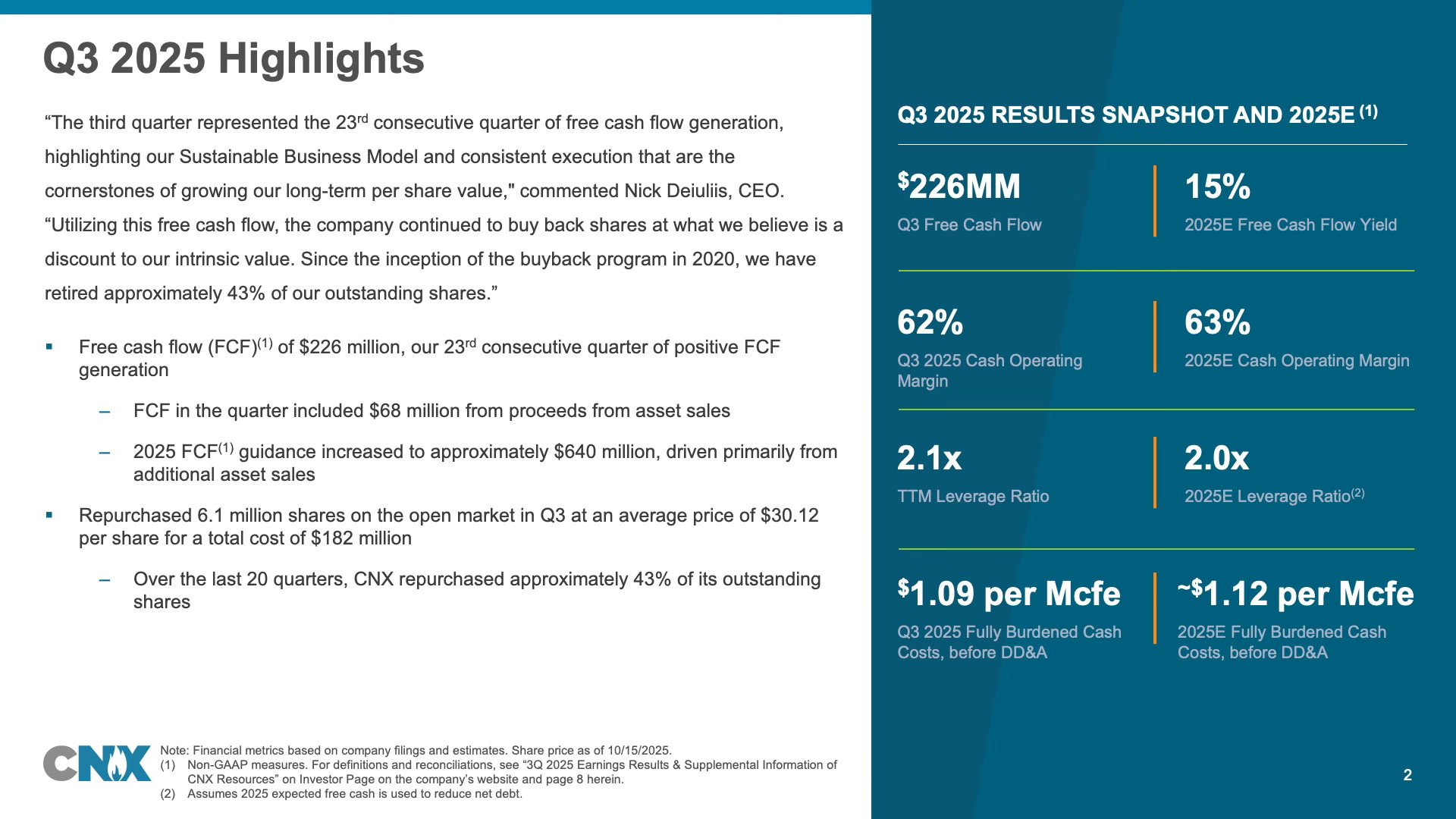

CNX Resources Corporation continued its streak of exceptional financial performance in the third quarter of 2025, generating $226 million in free cash flow and marking an impressive 23 consecutive quarters of positive free cash flow generation. The results underscore the strength of the company's Sustainable Business Model, commitment to operational excellence, and its Appalachia First vision.

"The third quarter represented the 23rd consecutive quarter of free cash flow generation, highlighting our Sustainable Business Model and consistent execution that are the cornerstones of growing our long-term per share value," said Nick Deiuliis, CNX Chief Executive Officer. Since launching its seven-year strategic plan in 2020, CNX has generated approximately $2.7 billion in cumulative free cash flow.

The company demonstrated disciplined capital allocation throughout the quarter, repurchasing 6.1 million shares at an average price of $30.12 per share for a total investment of $182 million. Since the inception of the buyback program in 2020, CNX has retired approximately 43% of its outstanding shares at an average price of $18.86 per share, representing a compound annual growth rate of approximately negative 11%.

CNX also executed strategic portfolio optimization during the quarter, divesting approximately 7,500 acres of Marcellus Shale rights located primarily in Monroe County, Ohio for net proceeds of $57 million, while agreeing to acquire Utica Shale rights across approximately 23,000 acres beneath its Apex Energy footprint for approximately $50 million.

The company raised its 2025 full-year free cash flow guidance to approximately $640 million, driven primarily by additional asset sales, and increased production volume guidance to 620-625 Bcfe. CNX also updated its expected 2025 free cash flow per share to $4.75, an increase of $0.68 per share from prior guidance.

On the environmental front, CNX continued advancing its industry-leading Radical Transparency program. With now 700,000 datapoints collected (and growing every hour), CNX has found no evidence of impacts from its gas development operations that would be harmful to human health or degrade local air quality, calling into question the need for expanded buffer zones in Pennsylvania, as some have proposed.

As 2025 draws to a close, CNX continues executing its Sustainable Business Model and delivering shareholder value throughout the commodity cycle.

For more, read CNX’s full Q3 2025 remarks, review accompanying slides, read results and information, watch a replay of the webcast from October 30, and regularly visit CNX’s news page for the latest company announcements.