CNX Delivers 22nd Consecutive Quarter of Free Cash Flow in Q2 2025

CNX Resources continued its strong operational and financial performance in the second quarter of 2025, marking its 22nd consecutive quarter of generating positive free cash flow (FCF).

July 24, 2025

By Positive Energy Hub Staff

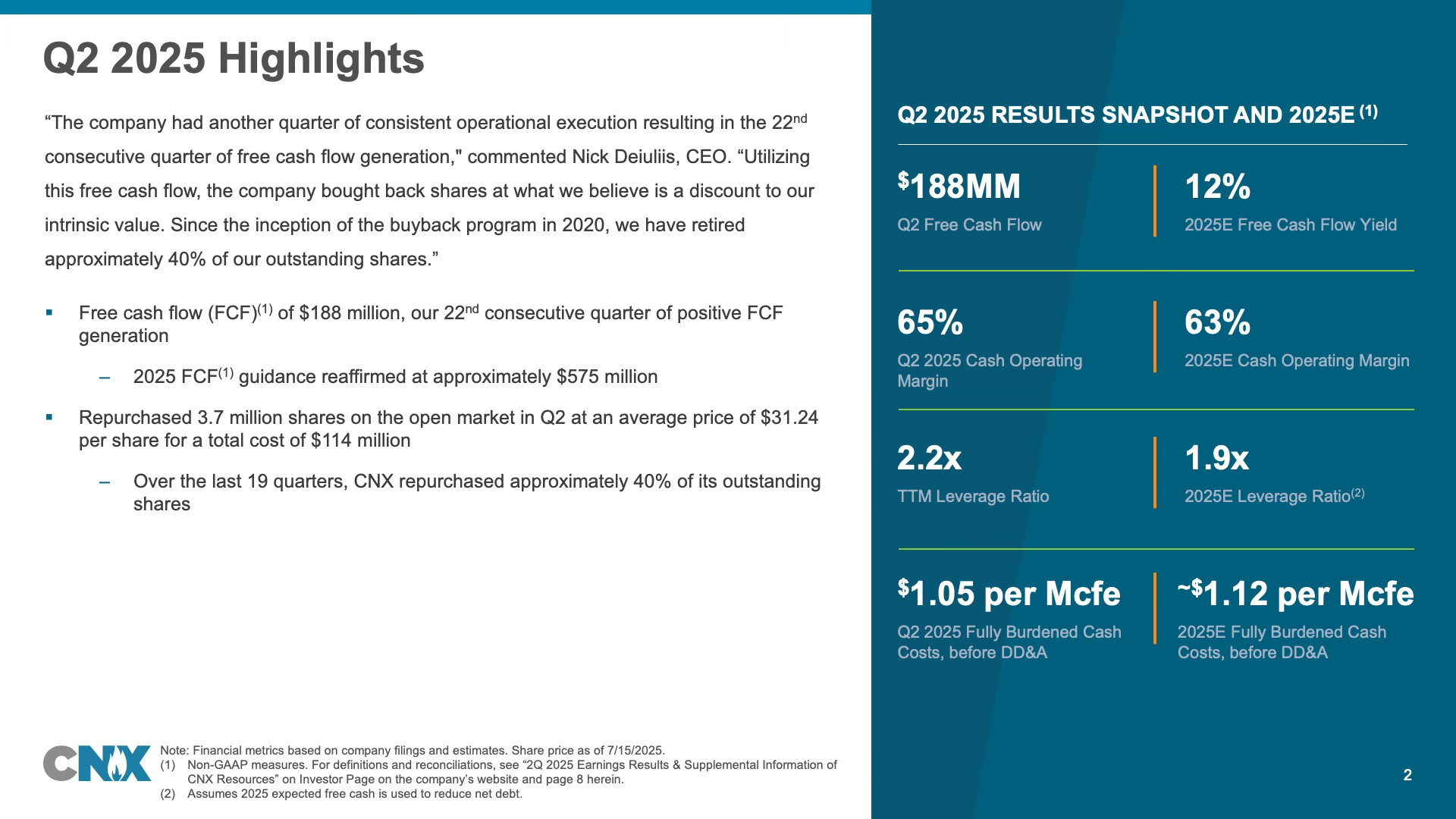

Generating $188 million in FCF for the quarter, CNX reinforced its reputation for disciplined capital allocation and a resilient, low-cost business model. Since the start of CNX’s 7-year plan in 2020, its differentiated business model has resulted in cumulative FCF of approximately $2.5 billion.

In line with its commitment to shareholder value, CNX repurchased 3.7 million shares for $114 million at an average price of $31.24 per share. This activity brought the total shares retired since 2020 to approximately 40% of outstanding shares—a record achieved through $1.6 billion in buybacks at an average price of $18.01 per share.

Operationally, CNX made significant strides with efficiency improvements in its drilling program. The company completed drilling three deep Utica wells with lateral lengths averaging about 11,100 feet at an average pace of 36 days per well—a 46% reduction in drilling days from 2023. Fully burdened cash costs decreased to $1.05 per Mcfe, reflecting a continued focus on cost leadership. As a result of strong production, annual production guidance was raised to 615–620 Bcfe.

The quarter also saw advances in CNX’s environmental initiatives. The company generated approximately $19 million from environmental attribute sales, capturing and selling 4.4 Bcf of Remediated Mine Gas (RMG). CNX is positioned to benefit further as federal programs recognize the value of capturing and utilizing RMG, potentially generating $30 million annually, with some expected contribution starting in 2026.

CNX also released its updated 2024 Corporate Sustainability Report. Moreover, the company is now updating Environmental, Social, and Governance (ESG) related topics on its website continuously, and its ESG Performance Scorecard data on a quarterly basis. One example of ongoing updates is CNX’s recently launched website page disclosing every Notice of Violation (NOV) the company receives.

Additionally, as part of the Radical Transparency efforts between Pennsylvania Governor Shapiro’s Administration and CNX, the Shapiro Administration launched a first-in-the-nation comprehensive air monitoring study.

Looking ahead, CNX reaffirmed its 2025 FCF guidance at approximately $575 million and expects FCF per share to increase to $4.07, supported by ongoing share reductions and its operational outlook. The company’s focus remains fixed on safe execution, value creation for shareholders, and transparent stakeholder engagement to support continued long-term growth.

For more, read CNX’s full Q2 2025 remarks, review accompanying slides, read results and information, watch a replay of the webcast from July 24, and regularly visit CNX’s news page for the latest company announcements.