CNX Resources Q1 2025: 21st Straight Quarter of Free Cash Flow

Operational excellence, disciplined share buybacks, and Apex Energy integration drive strong results and long-term shareholder value.

April 24, 2025

By Positive Energy Hub Staff

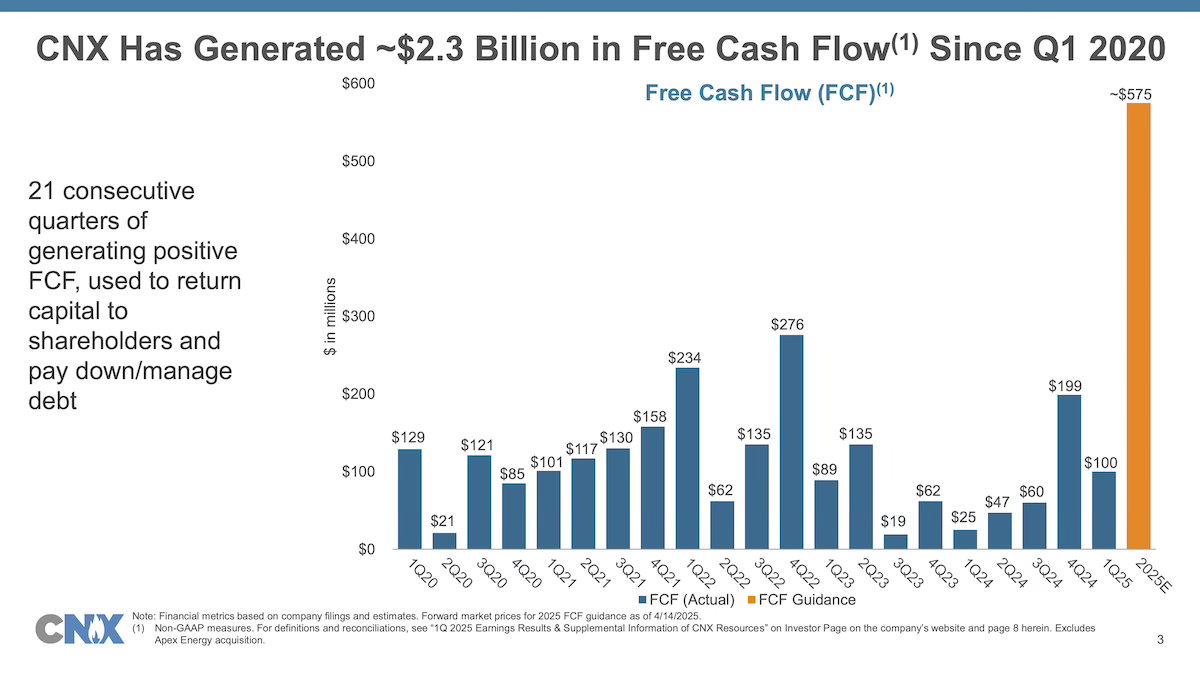

CNX Resources delivered a robust first quarter in 2025, generating $100 million in free cash flow (FCF)—its 21st consecutive quarter of positive FCF. This performance underscores the company’s resilient asset base, disciplined capital allocation, and industry-leading cost structure, which together have produced approximately $2.3 billion in cumulative FCF since the launch of its seven-year plan in 2020.

“The company had another quarter of consistent operational execution resulting in the 21st consecutive quarter of free cash flow generation. Utilizing this free cash flow, the company bought back shares at what we believe is a discount to our intrinsic value. Since the inception of the buyback program in 2020, we have retired approximately 38% of our outstanding shares.” - Nick Deiuliis, CNX President and CEO

Q1 2025 Highlights

- Generated $100 million in FCF, reaffirming 2025 FCF guidance at approximately $575 million.

- Achieved a 65% cash operating margin in Q1, with a 2025E cash operating margin of 62%.

- Maintained fully burdened cash costs of $1.11 per Mcfe before DD&A in Q1, with 2025E guidance at ~$1.12 per Mcfe.

- Repurchased 4.2 million shares in Q1 at an average price of $29.88 per share for $125 million and an additional 0.7 million shares post-quarter for $22 million.

- Since Q3 2020, CNX has repurchased approximately 86 million shares (38% of shares outstanding) for $1.5 billion at an average price of $17.46 per share, representing a -10% CAGR in share count.

- Closed the Apex Energy acquisition, increasing net debt to approximately $2.7 billion, partially funded by a $200 million Senior Notes issuance due 2032.

- Maintained significant liquidity with $2 billion in combined credit facility commitments and a weighted average senior unsecured debt maturity of 5.5 years.

Operational Update

CNX safely and efficiently executed its 2025 operations plan while integrating the Apex Energy acquisition. The company completed drilling one deep Utica well (14,200 ft lateral) and four Marcellus SWPA wells (average 15,300 ft laterals). The completions team set new records, including 504 monthly pumping hours and a daily record of 23.2 pumping hours.

Nineteen wells were turned in line (TIL’d) in Q1, including nine SWPA Marcellus wells, two CPA deep Utica wells, and eight wells from the Apex acquisition. All wells utilized AutoSep’s advanced flowback equipment, improving efficiency, safety, and environmental performance. CNX continues to expand the use of this technology with its joint venture partner.

ESG Leadership and Environmental Attributes

CNX’s Radical Transparency program continues to demonstrate that its natural gas development is safe and poses no public health risks.

All data is transparently posted on the CNX website, and the company encourages industry peers and stakeholders to follow suit.

The company recognized $19 million in net sales of environmental attributes in Q1, associated with 4.3 Bcf of coal mine methane (CMM). For 2025, CNX expects to capture 17–18 Bcf of CMM volumes, resulting in about $75 million of FCF at current market prices.

2025 Outlook

CNX reaffirmed its guidance for:

- Total annual production: 605–620 Bcfe

- Adjusted EBITDAX: $1,225–$1,275 million

- Capital expenditures: $450–$500 million

- 2025 FCF: ~$575 million (at NYMEX $3.76/MMBtu as of April 14, 2025)

- Updated 2025 FCF per share guidance: $3.97 (up $0.12 per share due to ongoing share repurchases)

For more, read CNX’s full Q1 2025 remarks, review accompanying slides, read results and information, watch a replay of the webcast from April 24, and regularly visit CNX’s news page for the latest company announcements.