CNX Extends Free Cash Flow Streak to 24 Quarters, Boosts Share Repurchase Capacity

January 29, 2026

By Positive Energy Hub Staff

As temperatures hovered in the low teens across southwestern Pennsylvania on Thursday, January 29, and natural gas reliably warmed and powered countless homes and businesses, CNX Resources released its fourth quarter 2025 earnings results.

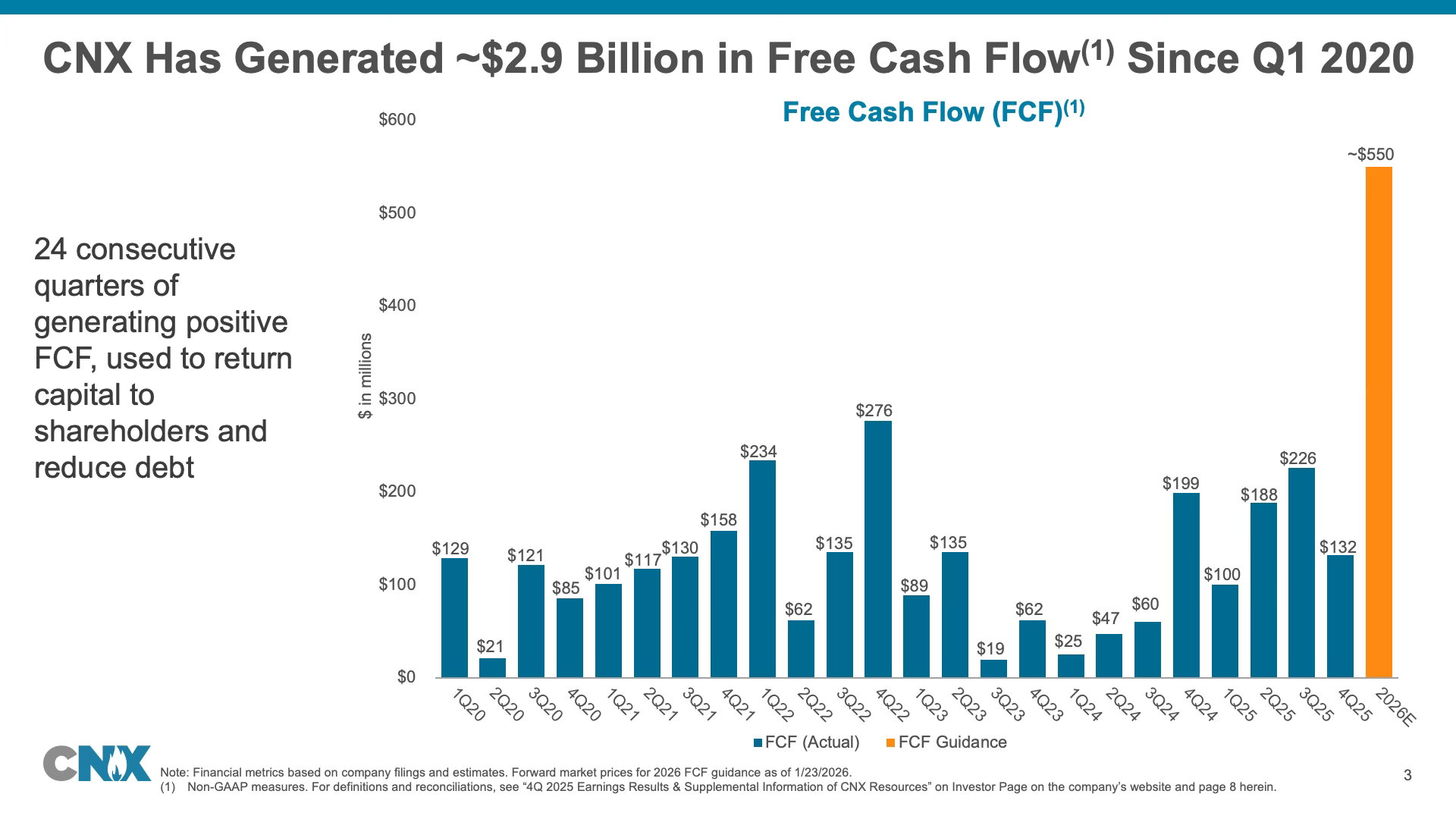

Those results underscore both the resilience of the region’s energy backbone and the strength of CNX’s Sustainable Business Model, which has now delivered 24 straight quarters—six full years—of free cash flow.

CNX generated $132 million in free cash flow in the fourth quarter and $646 million for the full year 2025, bringing total free cash flow under its seven-year plan, launched in 2020, to roughly $2.9 billion.

“The fourth quarter represented our 24th consecutive quarter of free cash flow generation, highlighting our Sustainable Business Model and consistent execution that are the cornerstones of growing our long-term per share value,” said Alan Shepard, President & CEO. “We continue to believe that our share repurchase program represents a compelling capital allocation opportunity, and as such, we are announcing an additional $2 billion share repurchase authorization, with no expiration. This new authorization increases our total authorized repurchase capacity to $2.4 billion, which represents approximately 45% of our current equity capitalization.”

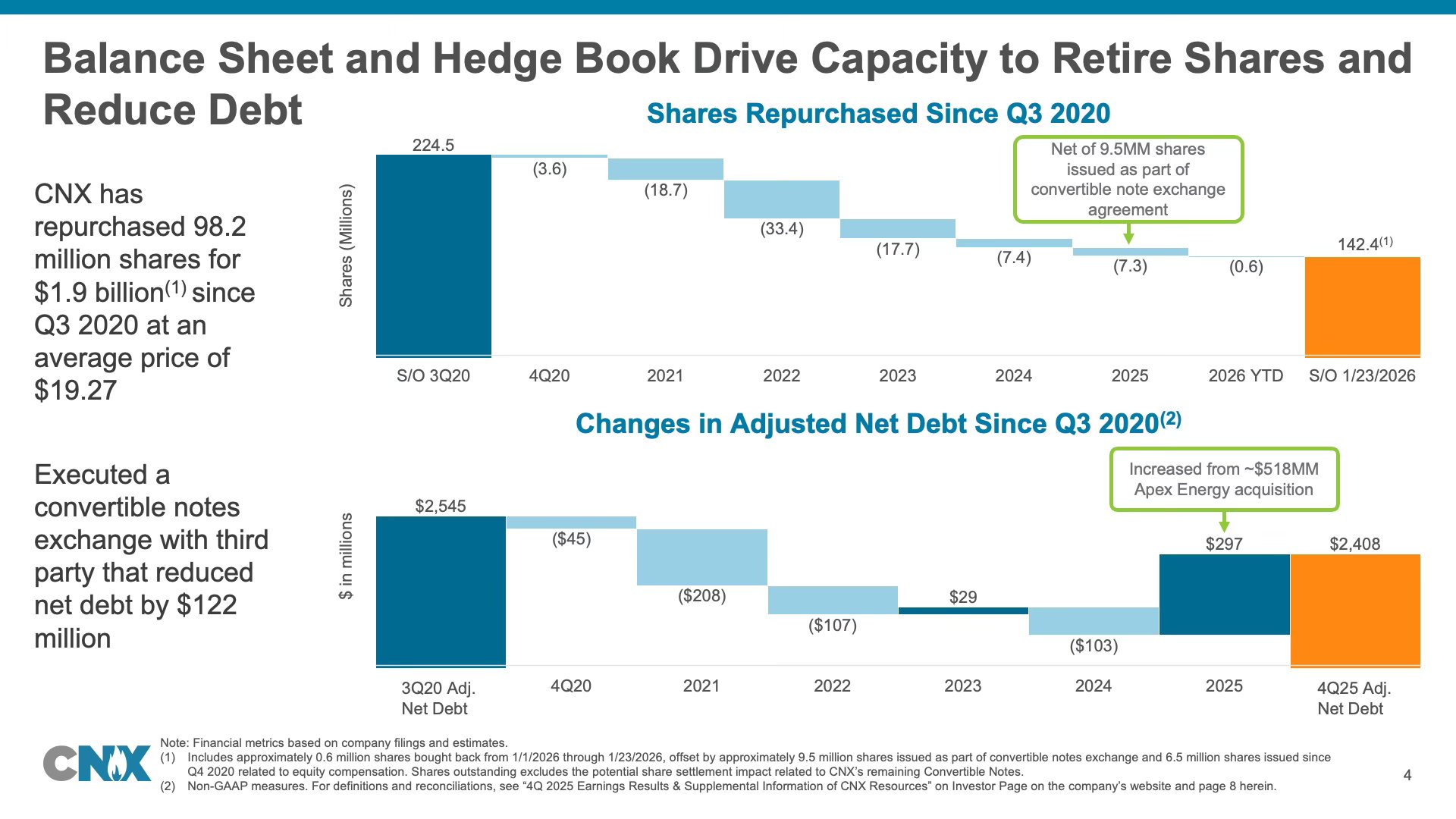

Returning cash to shareholders and strengthening the balance sheet

A central theme of CNX’s strategy is using that free cash flow to reward long-term shareholders. In the fourth quarter, CNX bought back about 2.9 million shares of its own stock on the open market at an average price of $34.05 per share, spending $100 million. Since late 2020, the company has repurchased around 98 million shares at an average price of $19.27, reducing its share count by about 37 percent when factoring in shares issued for employee compensation and convertible notes. Fewer shares mean each remaining share represents a larger ownership stake in the company.

The newly announced $2 billion authorization brings CNX’s total share repurchase capacity to roughly $2.4 billion, or about 45 percent of its current stock market value. At the same time, CNX has continued to work on its debt. During the fourth quarter, the company paid down $35 million on its secured credit facilities and reduced the principal on its convertible notes due 2026 by $122 million through an exchange for common stock.

Low costs and reliable production

Behind the financial results is a simple story: CNX is keeping costs low and wells performing.

In 2025, the company produced 629 billion cubic feet equivalent (Bcfe) of natural gas and liquids, modestly above the high end of its earlier guidance range of 625 Bcfe. That performance was supported by both its long-held assets and the properties acquired from Apex Energy.

CNX’s fully burdened cash costs for the fourth quarter were $1.11 per thousand cubic feet equivalent (Mcfe), before non-cash charges like depreciation. This cost level helps protect the business when gas prices are weak and allows more upside when prices are strong.

For 2026, CNX plans to keep production stable, following a “maintenance of production” program. CNX will focus on its core Marcellus Shale wells and continue to enhance its expertise and industry leading position in the deeper Utica Shale. Most of the spending and new wells are expected to come in the first half of the year, with production staying fairly steady from quarter to quarter.

Turning waste gas into value and focusing on transparency

A growing part of CNX’s story is premium, low-carbon products. CNX captures and processes waste Remediated Mine Gas (RMG)—methane that would otherwise leak from old coal mines into the atmosphere—and turns it into a useful domestic energy source. In the fourth quarter of 2025, that program generated about $14 million in net sales from environmental attributes tied to 4.3 Bcf of captured gas, and for the full year, 17.3 Bcf of RMG produced roughly $66 million. For 2026, CNX expects around 17 Bcf of RMG to support about $50 million in Pennsylvania Tier 1 Alternative Energy Credit sales at current prices.

CNX also anticipates about $20 million from the sale of federal Section 45Z Clean Fuel Production tax credits linked to about eight months of qualifying activity in 2025, pending final IRS rules expected around mid 2026.

On the environmental front, CNX’s Radical Transparency program continues to set the company apart. By the end of 2025, the company had collected more than 850,000 air quality measurements around its operations through continuous monitoring. This data shows no evidence that gas development activities are harming human health or degrading local air quality, a result that should be central to discussions about any new public policy for natural gas development in Pennsylvania.

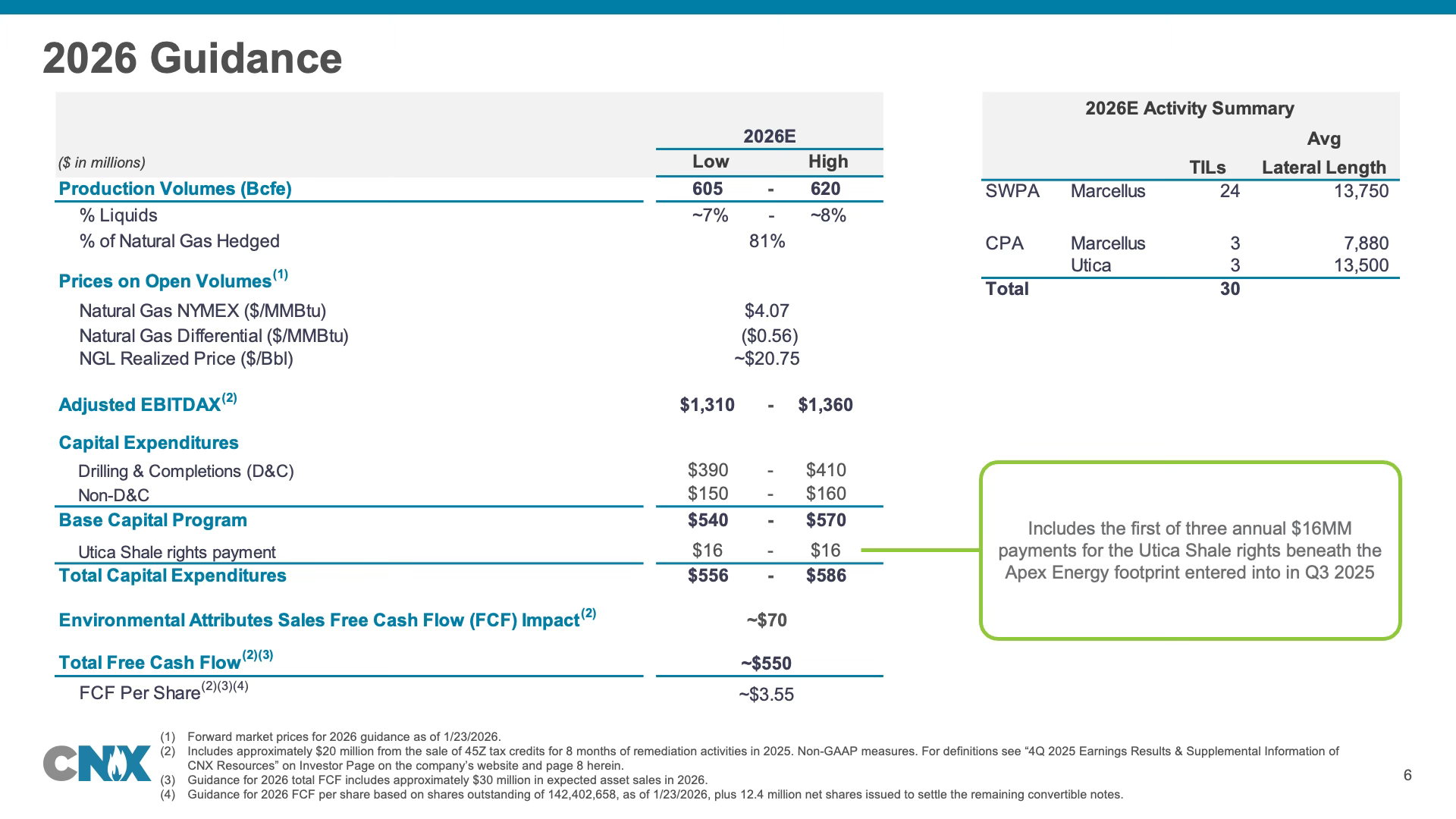

2026 outlook: strong cash generation and flexibility

Looking ahead, CNX expects to generate about $550 million in free cash flow in 2026 at current natural gas price expectations, or around $3.55 per share when including shares that may be issued to settle remaining convertible notes. The company’s 2026 outlook calls for production between 605 and 620 Bcfe and base capital spending of $540–$570 million, plus an additional $16 million payment related to Utica rights beneath the Apex acreage.

With an estimated free cash flow yield of about 11 percent, a strong hedge position, and approximately $1.8 billion of available credit facility capacity, CNX is well positioned to continue its Sustainable Business Model: investing in Appalachia, reducing debt when it makes sense, and returning significant cash to shareholders over time.

For more, read CNX’s full Q4 2025 remarks, review accompanying slides, read results and information, watch a replay of the webcast from January 29, and regularly visit CNX’s news page for the latest company announcements.