CNX New Technologies Business Unit Coming into Focus and Driving Future Success

Highlights from the company's 2023 Q2 earnings including 14 straight quarters of free cash flow generation and cash flow positive New Technologies business.

July 27, 2023

By Positive Energy Hub Staff

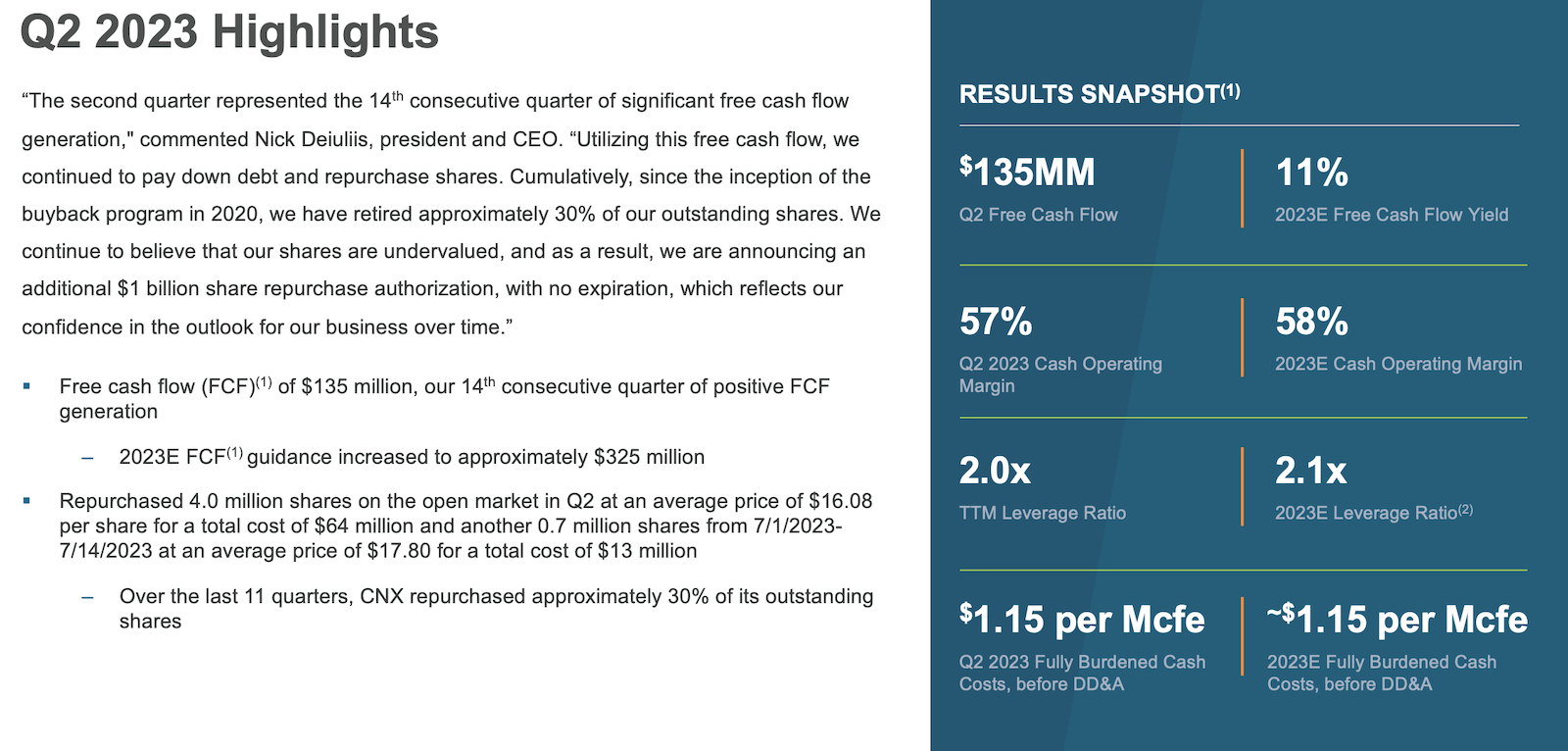

Rooted in a Sustainable Business Model that’s future-focused and unique to our company and Appalachian footprint, CNX marked its 14th consecutive quarter of free cash flow (FCF) generation in Q2 2023, the company announced in earnings today. The $135 million generated in Q2 brings cumulative free cash flow to approximately $1.8 billion since the birth of the seven-year plan in Q1 2020.

WHAT’S NEW?: The New Technologies business unit is now cash flow positive, and company executives expect the group will contribute approximately $75 million annually to FCF starting in 2024, with the potential of achieving up to $100 million next year.

- With this, “the long-term outlook for CNX and the natural gas industry as the cornerstone of our collective energy and economic future has never been brighter,” President and Chief Executive Officer Nick Deiuliis said during the earnings call.

Efficient development of our extensive asset base, continued growth of the New Technologies business unit, and clinically allocating FCF for share repurchasing were the focus of CNX’s long-term, per share value strategy this quarter and created these Tangible, Impactful, and Local results.

Highlights from the quarter include:

- THE OPERATIONAL LEADER IN THE BASIN:

- Chief Operating Officer Nav Behl:"The team has been able to establish a new level of operational efficiency, which is important because it drives our base level of free cash flow generation that supports our Sustainable Business Model. We are well positioned to adjust our activity set to respond to any material changes in gas pricing that may unfold in the second half of the year. This flexibility is one of the key advantages of being a low-cost producer and owning our midstream assets, as our well economics remain attractive even in lower pricing environments and we are not beholden to high fixed cost midstream arrangements that can lead to uneconomic decision making.”

- GROWING NEW TECH: Expanding CNG markets, reducing costs and emissions via oilfield services efficiencies, and developing awareness around the environmental and economic benefits of waste methane capture.

- Deiuliis: “Due to our one-of-a-kind asset base that underpins our Appalachia First vision, we have a wealth of opportunity to drive even more per share value creation through these efforts in the years ahead.”

- INVESTING IN APPALACHIA: Announced ARCH2 anchor project (Adams Fork Energy Clean Ammonia Facility) in Mingo County, WV.

- “Produce it here, use it here – first” in action. Project expected to create ~2,000 construction jobs, significant tax and capital investment revenue for WV, and abate ~2.7 million metric tons (MMT) of CO2 annually – all while leveraging abundant, Appalachian natural gas.

- New Tech Pres. Ravi Srivastava: "We’re very passionate about making [Adams Fork] successful…We’re working very hard from our side to make sure this is a success.”

- STRATEGIC SHARE REPURCHASING STRATEGY: Peer-leading strategy that’s repurchased over $1 billion in shares (30% of the company) since Q3 2020. Announced new $1 billion share repurchase authorization with no expiration.

- Deiuliis: $1 billion increase in share repurchasing program “provides another opportunity to create incredible value for our long-term, like-minded shareholders, who will benefit as their ownership continues to grow meaningfully over the coming years.”

- CORPORATE SUSTAINABILITY REPORT: Outlines how CNX’s effective corporate ESG initiatives are protecting and improving our environment, investing in local communities and workforce, and mitigating risk by aligning performance and enhancing diversity. Explore more at sustainability.cnx.com.

- Chief Risk Officer Hayley Scott: “Embracing innovative change that creates value for investors, enhances communities, and delivers energy solutions is what CNX champions to employees, contractors, and local partners. It’s what has made us resilient and ahead of the curve over the last century and a half and will continue to drive our success for decades to come.”

LOOKING AHEAD: Chief Financial Officer Alan Shepard: “Our focus for the remainder of 2023 will remain on safe and compliant execution to develop our extensive natural gas asset base, accelerating free cash flow growth from our New Technologies business, on consistent and clinical capital allocation to grow our long-term free cash flow per share, and most importantly, as always, on ensuring all our decisions continue to reflect a long-term owner mindset.”

Click HERE to read the full earnings release and presentation.

You May Also Like...