Total Impact Fee Distribution Tops $2.5 Billion to Pennsylvania Communities

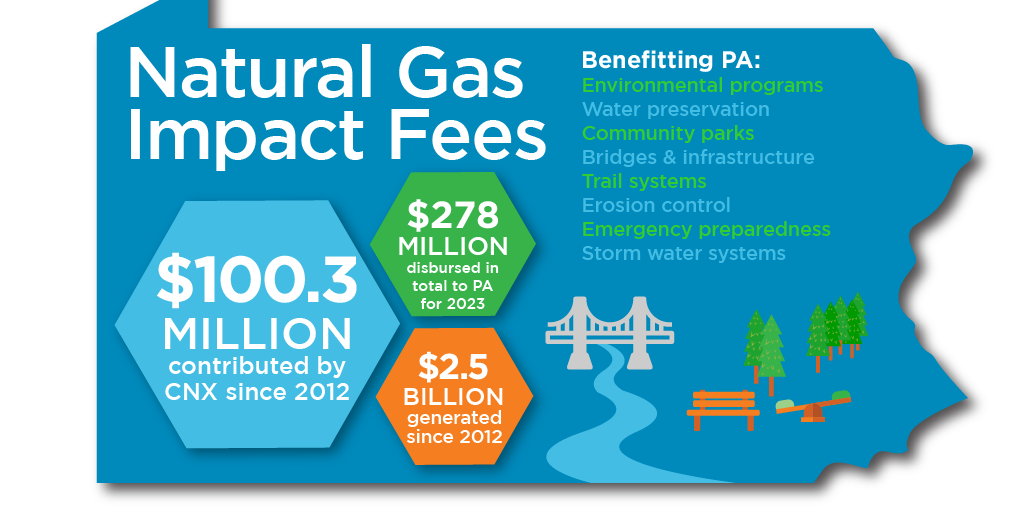

CNX contributions to PA communities reach $100 million since 2012.

June 26, 2023

By Positive Energy Hub Staff

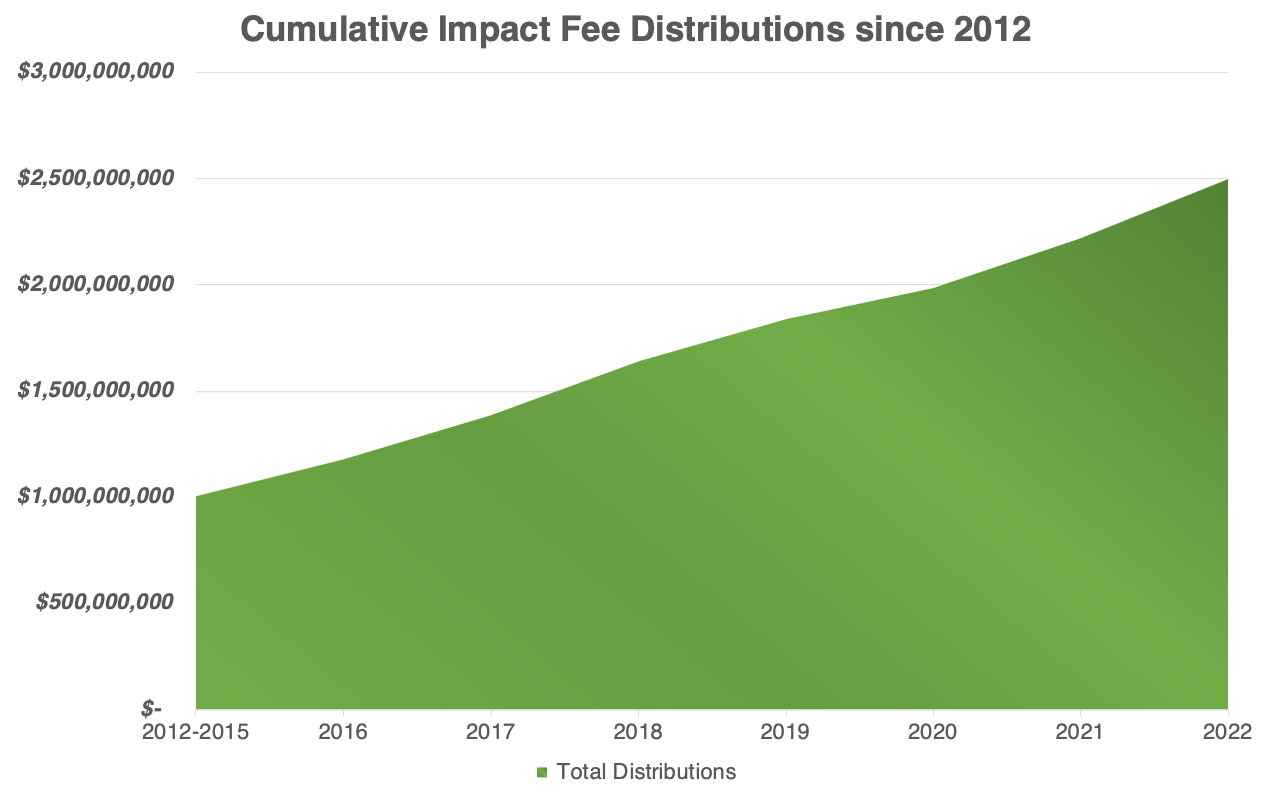

The Pennsylvania Public Utility Commission (PUC) recently shared information about this year’s distribution of impact fees on natural gas producers – totaling $278,881,450 – on the PUC’s Act 13 website. Of the $2.5 billion generated since the program’s inception in 2012, CNX has contributed more than $100 million to this tax program. More, our core operating counties – Washington and Greene – received among the largest returns this year at more than $9 million and $6 million, respectively.

Act 13 established a fee (also called an impact fee) on unconventional gas wells to be paid by natural gas producers, and the distribution of those funds to local and state governments in every county in the Commonwealth, particularly counties and municipalities where unconventional natural gas development is occurring. The funds cover local impacts of drilling in addition to discretionary uses such as public infrastructure improvements, emergency preparedness and response, environmental protection, social services, records management and tax reduction. Several state agencies also receive funding to be used for a variety of other purposes.

For the 2022 reporting year, county and municipal governments directly affected by drilling will receive a total of $157,349,593. Additionally, $103,641,907 will be transferred to the Marcellus Legacy Fund, which provides financial support for environmental, highway, water and sewer projects, rehabilitation of greenways and other projects throughout the state. Also, $17,889,950 will be distributed to state agencies, as specified by Act 13.

Washington County will receive the highest distribution of any county at $9.079 million, followed by Susquehanna and Bradford counties. Greene County receives the fourth most funds with $6.497 million.

“Washington County has been incredibly blessed being a leader in receipt of impact fees, which has allowed us to complete many capital expenditure projects in the county while keeping our county tax rate low,” Commission Chairwoman Diana Irey Vaughan said.

The distributions for individual municipalities are detailed on the PUC’s Act 13 website.

This year’s distribution is driven by an increase in the average price of natural gas of $6.64 per MMBtu in 2022 (versus $3.84 in 2021), which generated higher impact fee payments along with the addition of 574 new wells during 2022.

With this year’s distribution, the PUC has collected and distributed over $2.5 billion to Pennsylvania communities since Act 13 was signed into law in 2012.

“Pennsylvania natural gas development has delivered national energy security, cleaner air, consumer and economic gains here at home and abroad. The impact tax is yet another example of how the industry supports better quality of life for all Pennsylvanians,” Marcellus Shale Coalition President David Callahan said in a written statement.

Related Articles...